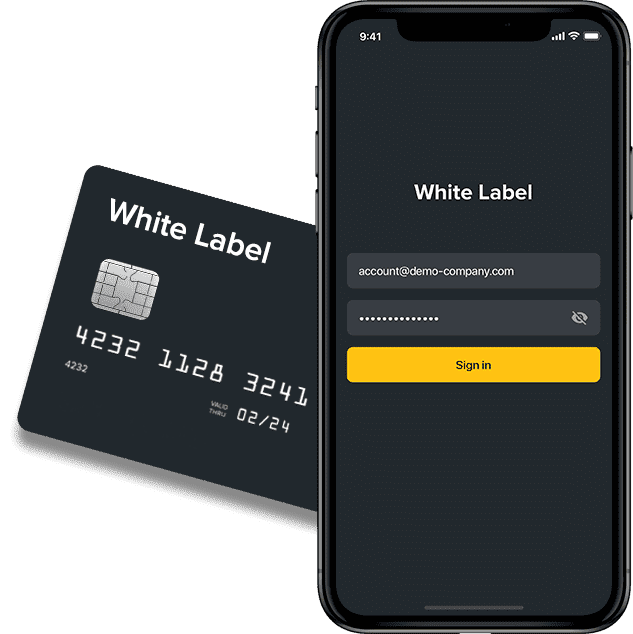

White Label Card Issuing Platform: Launch Your Branded Card Program in 2026

Go to market in 4-6 weeks with a complete white label card issuing solution. Monvenience provides Mastercard and Visa BIN sponsorship, robust API, compliance framework, and full program management—so you can focus on growing your business.

Complete Card Issuing Infrastructure for Fintech Innovation

In today's competitive financial landscape, speed-to-market is critical. Monvenience eliminates the complexity of becoming a licensed card issuer by providing a turnkey white label card issuing platform. We handle the regulatory licensing (EMI), Mastercard/Visa network agreements, PCI DSS compliance, and backend processing. You deliver a seamless, branded payment experience to your customers.

Whether you're a neobank, payroll provider, expense management platform, gig economy app, or crypto exchange, our flexible API supports virtual and physical debit, prepaid, and corporate card programs tailored to your specific use case.

Why Choose Our White Label Card Issuing Solution?

Powerful Issuing API

Full control via a single RESTful API. Issue cards, manage KYC, set spending limits, handle disputes, and access real-time analytics. Supports webhooks for instant transaction notifications.

Rapid Integration

Launch in weeks, not years. Avoid the 12-18 month process and 7-figure costs of obtaining your own card scheme licenses. Our sandbox environment gets your developers started immediately.

End-to-End Management

We manage the entire card lifecycle: BIN sponsorship, fraud monitoring (with AI rules), chargeback processing, card production, embossing, packaging, and global delivery.

Full Brand Customization

Your brand at the forefront. Custom card designs (plastic, metal, recycled), packaging, cardholder communications, and dedicated IBANs. White label mobile app SDK available.

Comprehensive Card Program Features

Our platform is built for scalability and security, providing everything you need to run a successful card program.

- Virtual & Physical Cards: Instant virtual card issuance for online spending, with physical card delivery worldwide.

- Advanced Security: 3D Secure 2.0, tokenization (Apple Pay, Google Pay), biometric authentication, and dynamic CVV.

- Real-time Controls: Card freezing/unfreezing, spending limit management (by merchant category, geography, transaction type).

- Funding & Settlement: Flexible funding options (wallet, bank transfer, crypto). Daily settlement reports and reconciliation files.

- Compliance Built-in: Integrated KYC/AML checks, transaction monitoring, sanction screening, and audit trails.

- Detailed Reporting: Real-time dashboards, transaction history, and customizable statements for cardholders.

Ideal for: Expense management, vendor payments, payroll, rewards & incentives, travel programs, and crypto off-ramping.

PCI DSS Compliant Payment Processing

Monvenience operates a Level 1 PCI DSS certified processing platform. We handle the heavy lifting of payment network integration, transaction authorization, clearing, and settlement, so you don't have to.

Scheme Network Access

Direct connectivity to Mastercard and Visa networks for optimal authorization rates and faster settlement.

Fraud & Risk Management

AI-powered fraud scoring, velocity checks, and manual review tools to minimize losses without disrupting genuine customers.

Dispute Resolution

Full chargeback and dispute management service, handling the entire process from retrieval requests to arbitration.

Global Card Production

Partner network for high-quality card manufacturing, personalization, and secure delivery to cardholders in 50+ countries.

Launch Your Card Program: A Streamlined 6-Step Process

Strategy & Scoping

Commercial & Legal

Technical Integration

Design & Branding

Testing & Certification

Go-Live & Scale

Frequently Asked Questions (FAQ)

White label card issuing allows your company to offer payment cards under your own brand without becoming a licensed card issuer yourself. We (the sponsor) provide our Mastercard/Visa license (BIN ranges), regulatory compliance, and processing infrastructure. You control the customer experience, branding, and product design. It's the fastest route to market for embedded finance products.

Our platform supports a wide range: Consumer debit cards (linked to an account/wallet), prepaid cards (for budgets, rewards, gig worker payouts), corporate cards (for employee expenses, vendor payments), and single-use virtual cards (for online subscriptions, travel). All cards are contactless (NFC) and can be added to digital wallets.

Timeline: From signed agreement to first live card in 4-6 weeks for standard programs. Costs: We operate a transparent B2B SaaS model. Costs typically include a setup fee, monthly platform fee, and per-card transaction fees. We avoid revenue sharing on interchange, so you keep more of your card program's earnings. Contact us for a detailed proposal.

Our EMI license allows us to sponsor programs for entities incorporated in the European Union/EEA. We can issue cards to cardholders globally, subject to local regulations and sanction checks. Please contact us to discuss your specific geographic requirements.

Ready to Launch Your Card Program?

Contact our partnership team today. Discuss your project, receive a customized solution brief, and get access to our API documentation.

© 2026 All Rights Reserved.