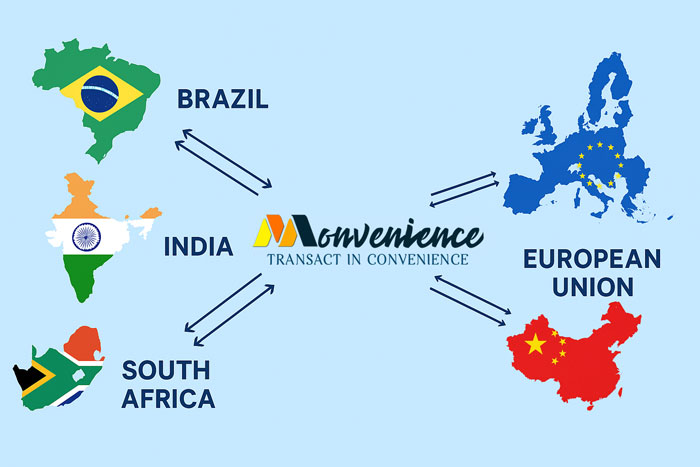

Multi-Currency ExIm Banking for BRICS Traders (Excluding Russia)

Global trade is evolving rapidly, and businesses in BRICS nations — Brazil, India, China, and South Africa (excluding Russia) are at the forefront of international commerce. Yet, traditional banking systems still make cross-border transactions slow, costly, and complicated.

The Challenge of Traditional Cross-Border Banking

Opening multiple bank accounts in different countries, paying high currency-conversion fees, and navigating complex compliance procedures are major pain points for exporters and importers. These issues can lead to delays, lost opportunities, and reduced profit margins.

The Monvenience Solution

Monvenience’s multi-currency SWIFT IBAN platform gives BRICS-region traders (except Russia) a single, powerful solution:

- Receive, hold, and send funds in 24+ major and emerging market currencies including INR, USD, EUR, CNY, BRL, ZAR, and more.

- No forced conversions — hold your funds until exchange rates work in your favor.

- Pay suppliers directly in their currency or repatriate profits on your own schedule.

- Access through an intuitive mobile app or secure web interface.

Compliance & Security You Can Trust

- Regulatory confidence: Operates via a fully regulated Electronic Money Institution under the oversight of the Bank of Lithuania (through our principal).

- Fund safeguarding: Client money held in segregated accounts at the Bank of Lithuania.

- Advanced security: 3D Secure, two-factor authentication (2FA), and decentralized security to protect your data and transactions.

- Reliable partnerships: Backed by a partnership with Mastercard Europe through our principal.

Frictionless Account Opening

- Apply online with your local business address and documents.

- No EU address or in-person bank visit required.

- Start sending and receiving SWIFT transfers once approved.

Why This Matters for BRICS Nations (Except Russia)

Trade between Brazil, India, China, and South Africa is expanding. Whether you’re an Indian textile exporter selling to Brazil, a South African mining company buying from China, or a Brazilian manufacturer importing from India — settling payments in local or third-party currencies gives you an edge in pricing, delivery speed, and customer trust.

Monvenience lets you consolidate multi-currency flows into one account, time your conversions strategically, and stay compliant under strict EU-grade rules — all without maintaining multiple banking relationships.

Supported Currencies (24+)

INR, CNH, EUR, USD, GBP, CHF, CAD, JPY, AUD, SGD, DKK, HKD, HRK, HUF, RON, IDR, MXN, MYR, NOK, PHP, PLN, CZK, SEK, BGN.

Founded for Traders, Built for Scale

Established in 2017 and recognized with multiple SME finance awards, Monvenience combines global reach with localized support. Manage everything from a single dashboard — on the go with our mobile app, or at your desk via the secure web platform.

Ready to simplify your cross-border trade?

Open Your Multi-Currency Account Today

Frequently Asked Questions

How can exporters receive payments in multiple currencies?

Open a Monvenience SWIFT IBAN business account to receive funds in 24+ currencies without maintaining separate bank accounts or accepting forced conversions.

Do I need a local EU address to open a Monvenience account?

No. Any business worldwide (except Russia) can apply online with its local address and documentation — no in-person visit is required.

Can I repatriate funds back to my home country?

Yes. You can hold balances and repatriate profits when it suits your cash-flow and FX strategy, or pay international suppliers directly from the same account.

Is this platform suitable for BRICS traders?

Monvenience serves businesses in Brazil, India, China, and South Africa. Russian businesses are not accepted at this time.

© 2026 All Rights Reserved.