Simplify Global Business with Monvenience's Online Multi-Currency Own Name SWIFT IBAN Accounts

Get Your Own Name, Dedicated Multi-Currency SWIFT IBAN Accounts

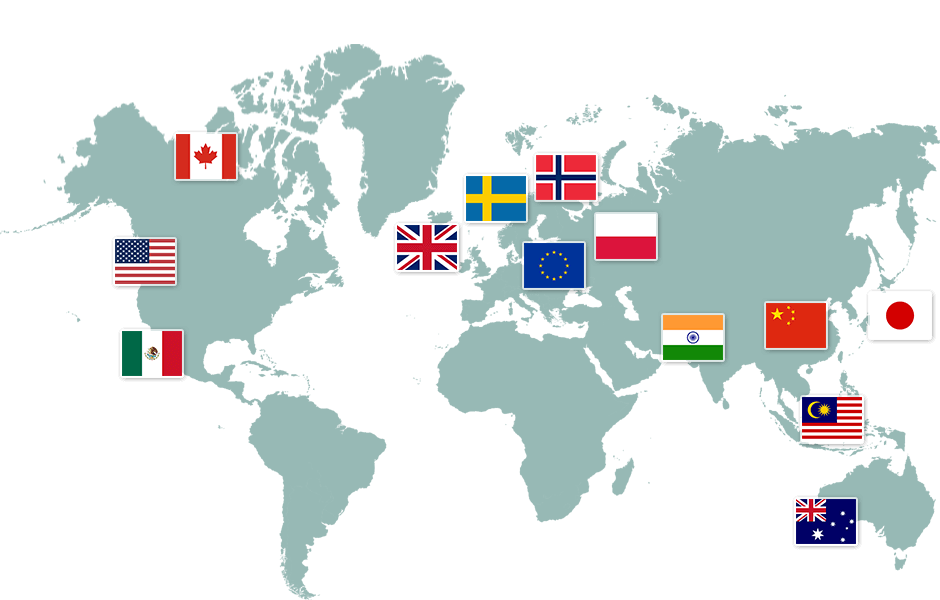

An IBAN with SWIFT capability gives you virtually unparalled power of cross border and inter continent fund transfers. The IBAN practically makes your bank account function like a local bank account in EU and EEA, while the SWIFT capability helps you to transfer it (or receive remittances) to and from other geographies, like the US, Asia and Australia. It brings the world's banking system to your disposal, connecting you to every financial backbone infrastructure. An ultimate in cross border remittances.

Effortless Global Transactions:

Monvenience's innovative multi-currency business accounts empower you to navigate the complexities of international trade with ease. Send and receive payments seamlessly from partners, suppliers, and customers worldwide, in multi-currency, and in SEPA or SWIFT. Make your international remittances with ease. Application and Management of these IBAN accounts are completely online, through your laptop or secured mobile app.The SWIFT IBANs will be in the name of the company or your individual self, dedicated for you (not shared). And you can choose from a number of currencies as given below

Who can Use these Multi-currency IBAN accounts: Benefits for Diverse Businesses and Individuals:

- Import/Export: Secure favorable foreign exchange rates, optimize transactions, and minimize financial risks.

- E-commerce: Simplify international payments for suppliers, partners, and customers, boosting your global reach.

- Underserved Industries and High Risk Accounts: Access secure digital banking solutions specifically designed for licensed gambling businesses worldwide.

(Procedure: If your application is rejected in the normal SWIFT application, then we will be in touch with you for an High Risk account provider option, with special fees) - Consulting & Marketing: Efficiently manage revenue and expenses in various currencies, gaining financial clarity.

- Travel & Hospitality: Effortlessly manage payments from international clients and partners, enhancing customer experience.

- Cross-Border Trade: Optimize financial strategies with seamless international transactions and transparent fees.

Global Reach, Local Support:

Unlock a world of opportunity with Monvenience's business multi-currency SWIFT IBAN online bank accounts. Conduct cross-border transactions and remittance in over 24 currencies with unrivaled ease. Enjoy personalized customer support and manage your accounts conveniently through our user-friendly mobile app or web interface.

Our Unique SWIFT multi-currency accounts for corporate clients come with a wide range of currencies available including EUR, USD, GBP, CHF, CAD, JPY, AUD, SGD, DKK, HKD, CNH, HRK, HUF, RON, IDR, INR, MXN, MYR, NOK, PHP, PLN, CZK, SEK, and BGN. Enjoy Convenience of both SEPA and SWIFT from one platform!

Transact with Confidence:

Established in 2017, and multiple SME finance award winner, Monvenience prioritizes your security. With the help of our principal, we operate as a fully regulated electronic money institution under the strict oversight of the Bank of Lithuania.

- Regulatory Compliance: Functioning under the same regulatory framework as traditional banks through our Principal.

- Fund Security: Your funds are held securely in segregated accounts at the Bank of Lithuania.

- Advanced Security Features: We utilize industry-leading security protocols like 3D Secure and two-factor authentication (2FA) for enhanced protection.

- Reliable Partnerships: Our partnership with Mastercard Europe through our Principal ensures secure transactions.

- Decentralized Security: We leverage decentralized security protocols to safeguard your personal data.

Embrace Currency Freedom:

Monvenience empowers your business with the freedom to transact in a wide range of global currencies. Check below to see all the currencies we work with in our IBAN accounts. Our extensive network of partner banks and financial institutions facilitates seamless international transactions, propelling your business forward on a global scale. We us, you can leave your global remittances responsibilities to us, and concentrate on developing your cross border businesses.

How to Get your Multi Currency IBAN account:

Open your unique multi-currency business account with Monvenience today and experience the power of simplified global finance!

Click here for Documents Required Click here to know the SWIFT IBAN rates Apply for your IBAN account

For New Users:

Apply for your IBAN account, with the following documents (Click Here for document list) ready in your computer.

Before you apply, check the rates and charges.

After you have been awarded your account after compliance checks (takes about 2 weeks), you will find the link and form in your login panel to include your multi currency option to your IBAN account, as given below. Click here to apply for your account.

For existing users:

- Login to your account (Web Interface only, through a laptop or PC).

- Navigate to the 'Accounts' Tab.

- Select 'New Account'.

- Choose SWIFT option, and submit the online form.

FOR HIGH-RISK BUSINESSES:

You will still need to apply for your IBAN the normal way, and you will have the option of applying for your own name, dedicated SWIFT account, or a shared SWIFT account with your own unique identifier, in the name of our Principal. PLEASE NOTE: The accounts for High-Risk Businesses attract special charges, and you will need to get in touch with us, AFTER you have applied for and your SEPA account is approved by our compliance team.

Advantages:

Having a fully online application and management system for a European IBAN (International Bank Account Number) with multi-currency SWIFT capability can offer several significant advantages. Here’s a detailed look at the benefits:

1. Convenience and Accessibility

- 24/7 Access: You can manage your account anytime and from anywhere, as long as you have an internet connection. This is especially beneficial for businesses and individuals who need to conduct transactions outside of traditional banking hours.

- User-Friendly Interface: Online platforms often provide intuitive and user-friendly interfaces, making it easier to manage your account, view statements, and perform transactions.

2. Cost Efficiency

- Reduced Fees: Online management can lower administrative costs and fees associated with physical banking services. This includes savings on branch visits and reduced paperwork.

- Competitive Exchange Rates: Many online banking platforms offer competitive rates for currency conversion, potentially saving money on international transactions.

3. Enhanced Functionality

- Multi-Currency Transactions: With multi-currency SWIFT capability, you can handle transactions in multiple currencies seamlessly. This is ideal for businesses with international operations or individuals with global financial interests.

- Real-Time Updates: Online platforms often provide real-time updates on transactions, exchange rates, and account balances, allowing for more informed financial management.

4. Efficiency in Transaction Processing

- Speed: Online systems can process transactions faster than traditional methods. SWIFT transactions are typically processed quickly, and online management allows for immediate initiation of transactions.

- Automated Processes: Features like automated payment scheduling and recurring transactions can save time and reduce the risk of errors.

5. Improved Security

- Advanced Security Features: Reputable online platforms employ robust security measures, including encryption, two-factor authentication, and fraud detection systems, to protect your financial information.

- Instant Alerts: You can receive instant notifications for any suspicious activity or transactions, enhancing security and allowing for quick responses to potential issues.

6. Global Reach

- International Transactions: SWIFT capability ensures that you can send and receive money internationally with ease, without the need for intermediaries or complex procedures.

- Global Business Operations: For businesses, having a multi-currency IBAN allows for seamless transactions with global clients and partners, facilitating international trade and investment.

7. Streamlined Financial Management

- Integrated Solutions: We also offer prepaid payroll cards with your account, and multiple prepaid cards, physical and virtual, making it easier to manage finances and keep accurate records.

- Centralized Management: You can manage all your banking needs from a single online platform, reducing the complexity of dealing with multiple banks or accounts.

8. Regulatory Compliance

- Adherence to EU Regulations: A European IBAN ensures compliance with EU banking regulations, including anti-money laundering and Know Your Customer (KYC) requirements, which can simplify regulatory adherence.

© 2024 All Rights Reserved.