Online IBAN Account for Non-EU Businesses and Individuals

Open a European IBAN account remotely from anywhere in the world.

Open Your Offshore IBAN Account Remotely

Monvenience allows non-EU individuals and businesses to open a fully functional European IBAN account online. You can submit your passport, domestic business documents, and home bank statements - all remotely - without visiting a branch.

Accounts are SEPA-ready and include SWIFT for international transfers across Europe and beyond.

Who Benefits Most?

This service is ideal for:

- Freelancers working with EU clients

- Ecommerce exporters selling internationally

- International contractors and consultants

- Non-resident entrepreneurs and startups outside the EU

LT IBAN vs. Local EU Bank Account vs. Multi-Currency Fintech

| Account Type | Opening Ease | Currency Support | Fees |

|---|---|---|---|

| LT IBAN Account Online | Fully remote | Multi-currency | Low |

| Local EU Bank Account | Branch visit required | Single/EUR | Moderate |

| Multi-Currency Fintech | Remote, app-based | Multi-currency | Varies |

Typical Costs (Corporate - EU )

| Service | Fee |

|---|---|

| Monthly Maintenance | €35 |

| Card issuance fee | €9 |

| Incoming SEPA | 0.1% max €100 |

| Outgoing SEPA | 0.1% max €100 |

| SWIFT Incoming Transfer | 0.2% min €15, max €400 |

| SWIFT Outgoing Transfer | 0.5% min €20 |

How to Open Your Online IBAN Account

- Submit your valid passport and proof of address.

- Provide domestic business documents if opening a corporate account.

- Complete the KYC and compliance checks remotely.

- Receive your European IBAN and start managing your account online.

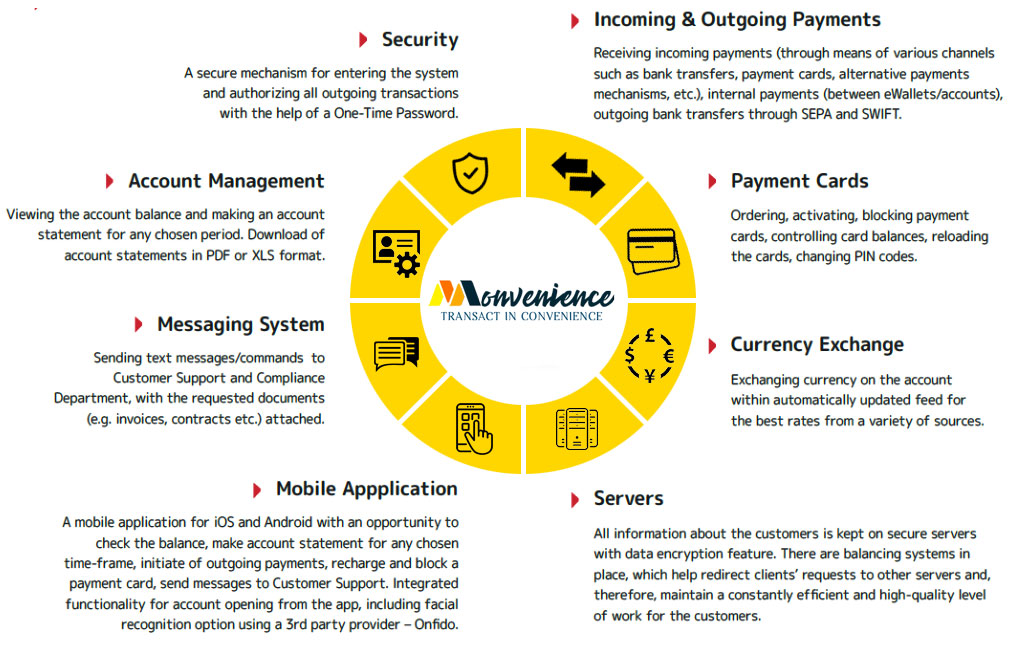

The Following Diagram gives a snapshot of our basic IBAN account:

International IBAN Account from Monvenience

KYC & Approval Timelines

Typical account verification takes 2–5 business days. Delays may occur due to missing documents or countries under restricted jurisdiction.

Why Choose a European IBAN Account?

- Global recognition and security in EU banking

- Multi-currency and SEPA/SWIFT enabled

- Full remote account management

- Cost savings on international transfers

- Fast, reliable transactions

Frequently Asked Questions

Can non-EU residents open an account?

Yes. Monvenience facilitates online IBAN accounts for both individuals and companies outside the EU.

What documents are required?

Passport, proof of address, and corporate incorporation documents (if applicable).

Are there restricted countries?

Yes. Some FATF grey-list jurisdictions are restricted. See restricted jurisdictions.

Where can I check fees?

See our EU Bank Account Rates & Charges page.

Find out if your country is in the restricted jurisdiction list

Not sure if your country is in the list? Find out if your country is eligible below:

© 2026 All Rights Reserved.